"There is a still further factor that makes it improbable that the wealth created by government spending will fully compensate for the wealth destroyed by the taxes imposed to pay for that spending." - Henry Hazlitt, Economics In One Lesson – page 37 from the Chapter entitled Taxes Discourage Production. Hazlitt's statement is the bedrock economic position separating statists from libertarians.

click on graphic to enlarge

click on graphic to enlarge

This post scrutinizes the economic effects brought about by the federal income tax system of the U.S. for the past 104 years to determine which fiscal & monetary policy mix produced the most prosperity & economic growth & how close the current tax reform legislation being developed (currently in a House – Senate conference committee) comes to meeting this criteria.

The federal income tax system was enacted in 1913 & ever since there has never been another main source of general revenue seriously considered by the American people or their elected representatives to replace it - including the FairTax.

Although 104 years seems like a long time to learn the optimum policy mix there were many events, like world wars, that interrupted normal times & competing economic theories that needed time to play out to see what worked & what didn't.

The income tax, ratified by the 16th Amendment in 1913, was originally conceived as a flat tax with a single rate of 4% but it quickly changed to a graduated tax of 1% to 7% with the income tax brackets determined by the ability to pay. Before the decade was out the top income tax rate had been raised from 7% to over 75%.

Starting in 1923 President Coolidge instituted a policy of drastic reductions in income tax rates that stimulated productive investment by corporations & wealthy individuals that benefited the entire society by raising incomes & living standards. President Coolidge was the only president to ever follow all of what became known today as supply-side economic principles: 1) the reduction of the size of government, including regulations, & its claims on earned income, 2) a lower marginal tax rate for the highest income earners, & 3) sound-money policies. Silent Cal reduced the top 73% income tax rate to 25% by 1925, reduced the national debt, & balanced the budget – a budget that actually was smaller when he left office than when he took office. Federal spending was 3% of GDP in 1928 – it is 22% today. Trace the green line shown in the 1920s horizontally across to the present day in the above graphic & you will see that the top income tax rate has never been lower than when President Coolidge was president. Coolidge's time in office was for the most part a time of economic prosperity, known as the Roaring Twenties – a triumphant period that established our modern way of life.

The Great Depression of the 1930s & 1940s followed - brought about principally by the enactment of the Smoot-Hawley Traffic Act of 1930 & the retaliatory actions of country after country. By 1933, nearly half of America's banks had failed, & unemployment was approaching 15 million people, or 30 percent of the workforce. FDR's policy mix was for higher taxes & loose money – he devalued the dollar compared to gold & exacerbated the condition by raising the top income tax rate to 63% in 1932, to 79% in 1936, & to over 90% during WW II. The Fed made mistakes @ the start of the Depression by failing to increase the money supply to fight price deflation. Worse, FDR hated business – the opposite of Coolidge's basic belief that "the chief business of the American people is business" later shortened to "the business of America is business." The premise of FDR's New Deal of government programs & spending was that the crisis was permanent – known as secular stagnation during BO's time in office.

So by the end of WW II Americans had become use to government programs although they still liked their freedom – the two are not compatible in the long run.

The 1950s proved that the American economy was quite capable of producing 4+% economic growth rates even under terrible policy mixes; however the problem was that from 1949 to 1961 there were four recessions – twelve years of boom & bust that hurt many people during the busts. The Eisenhower policy (Republican's in general in the 1950s) was that you needed high tax rates to close the deficit in order for the economy to grow, & that government spending (Keynesian economics) – mostly spending on defense & transportation – was the best way to forestall recessions; hence, a 91% top income tax rate in the 1950s which no one paid because of deductions known as tax loopholes. (Today commentators like Sean Hannity like to take their top income tax rate of 39.6% & add the 3.8% ObamaCare investment tax, payroll taxes, property taxes, sales taxes, & state & local income taxes & say they are paying well over 60% of their incomes in taxes. If Sean had worked in the 1950s & started @ 91%, instead of 39.6%, & added all of the additional taxes of the day he would be over 100% so we know no one was paying the 91% rate in the 1950s.)

President Kennedy was the second supply side economics president, after Calvin Coolidge, who knew cuts to the highest income tax rates would produce economic gains. Click here to hear JFK explain the way the world works in a nationally broadcast speech on August 13, 1962. JFK proposed a supply side tax rate cut of 30% for the top (91% down to 65%) & bottom (20% to 14%) rates with a little less for the other brackets. JFK supported a strong dollar linked to gold & proposed elimination or reduction of some two dozen exemptions (i.e., loopholes) to taxable income like the home mortgage interest deduction & the charitable deduction – sound familiar over 50 years later?

The final bill known as the Revenue Act of 1964 had a top individual rate of 70%, a reduction of the corporate tax rate from 52% to 48% with larger cuts for small businesses, & the reforms (loopholes & deductions) that JFK wanted were small meaning that the top individual rate was really lower than 70% for many people because the loopholes still existed.

JFK had to fight the instincts of the times though – from 1948 to 1964 federal spending had increased 2.5 fold while the population increased only one third during this 16 year period. During JFK's first two years in office government spending increased, as recommended by Paul Samuelson & JFK's Council of Economic Advisers headed by Walter Heller & CEA member James Tobin, but from 1964 to 1965, when the first phase of the tax rate reductions took place, federal spending decreased for the first time since 1955 & the last time until 2010. The economic growth that resulted from the federal tax rate reduction caused state & local revenues to increase by 40% from 1963 to 1969.

The following graph shows the increases in federal tax revenue that followed JFK's tax rate cuts that were phased in over two years following his assassination in November 1963: most of the rate reductions would come in 1964 with the reminder coming in 1965.

click on graph to enlarge

click on graph to enlarge

And unemployment fell precipitously as a result of JFK's supply side tax rate cuts – see graph below:

click on graph to enlarge

click on graph to enlarge

But the Kennedy tax rate reductions were followed by the two presidents that BO has called the most liberal in the country's history – Johnson & Nixon.

Spending was starting to ramp up with both Johnson's Great Society program & the Viet Nam war. Then LBJ instituted a 10% tax surcharge in June 1968 that in essence pushed the income tax rates lowered under JFK back up 10%. Inflation started to pick up 1% each year & reached 6% in 1969, as the Fed ended the strong dollar policy under Kennedy by lowering real interest rates thereby destroying all of JFK's growth policies.

Nixon's idea of tax incentives was exemptions, credits, deductions, & write-offs – all of which will put money in people's pockets but will not change their incentives for growth like

marginal rate cuts would, which are the real growth drivers in an income tax system. Nixon kept the Johnson tax surcharge & added a new tax of his own, raised the capital gains tax from 25% to 35%, & instituted the alternative minimum tax (AMT), another supplemental income tax required in addition to baseline income tax that was put in place in 1970 because 155 high income earners escaped paying any federal tax the year before – today tens of millions of people are subjected to the AMT, which is not planned to be eliminated by the current Senate tax bill in the conference committee.

A double dip recession was experienced in 1969 – 1970 with 12% inflation through the two years of recession while 2.5 million people became unemployed by 1971 – these people depleted their savings as inflation ravaged upward. Economic growth for Nixon's first twenty one months was cumulatively 0.36%.

On Sunday night August 15, 1971 (I was in Ocean City, Maryland watching on TV) Nixon announced that he was completely ending the dollar's link to gold, was freezing wages & prices for 90 days, & was imposing an import surtax of 10%.

Nixon authorized the creation of both the Environmental Protection Agency (EPA) & the Occupational Safety & Health Administration (OSHA).

As the 1970s ended people were far too familiar with terms like inflation, stagflation, misery index, & government regulatory agencies. I knew several businessmen who thought "America has topped." From 1973 to 1982 there were three recessions, four years of negative growth, & only 2.3% average annual growth.

President Reagan had earned a college degree majoring in economics in 1932 so his formative years of study were spent around the time of Coolidge's supply side economics achievements – & Reagan did not forget the lesson.

By August of Reagan's first year in office Congress had passed the Economic Recovery Tax Act (ERTA) in which income tax rates were reduced 5% on October 1, 1981, 10% on July 1, 1982, & 10% on July 1, 1983 with the tax brackets indexed for inflation starting in 1985 – this brought relief from the insidious stealth tax of bracket creep meaning that people would not automatically see their income tax burden increase as they received raises or promotions that pushed them into higher tax brackets as had happened for decades with the 25 income tax brackets strategically placed every few thousand dollars higher to maximize bracket creep revenue for the government. Note: the income tax bills in the House & Senate conference committee could change the indexing method from CPI indexing to chained CPI indexing which will accelerate people's incomes moving to higher brackets thereby @ least partially undoing the Reagan indexing.

In 1985 Democrats led by Dan Rostenkowski, Dick Gephardt, & Bill Bradley introduced a bill that would reduce income tax rates even more than ERTA did – the Tax Reform Act of 1986, with a top rate of 28%. The bill passed the Senate 97 to 3 with Ted Kennedy, Joe Biden, Paul Sarbanes, Chris Dodd, Al Gore Jr., & John Kerry all voting for it – my how things have changed. What is it that has changed?

Once Reagan's income tax rate reductions went into effect economic growth went up 5.3% in the first quarter of 1983 followed by five consecutive quarters of over 7% growth finishing out the decade of the 1980s @ 4% growth per year. Employment & wages both increased throughout the decade & stagflation was swept into the ash heap of history.

This Reagan policy prosperity continued, even through GHW Bush's tax increase & recession of 1990 & the Clinton tax increase of 1993 & the attempt by his wife to implement HillaryCare. Gingrich led the Republicans to take the House & Senate in 1994 & Clinton moderated his approach – something BO never did. Gingrich led the effort to cut the capital gains tax rate from 28% to 20%, which Clinton signed into law. Spending was also brought under control & Clinton declared "the era of big government is over."

This Gingrich prosperity lasted from 1994 to 2001 when GW Bush, working with loose money from the Fed, started programs of exemptions & tax credits (like the Child Tax Credit increase from $500 to $1,000) that added income but not growth. What small tax rate reductions to the marginal tax brackets that were made under Bush were all originally scheduled to expire in 2010 so there was no permanency or real growth to be had. The top marginal rate was raised back to the pre-Bush era rate of 39.6% in 2012. BO followed Bush & RTE has well documented over the years that not one of BO's policies can be identified that would improve an economy. In fact they were purposely designed to hurt the economy as BO famously told Joe the Plumber a few days before the 2008 presidential election – BO was interested in fairness not maximizing government revenue.

The above walk through of the history of the American economy under a 104 year old income tax system shows that the periods of the 1920s, second half of the 1960s, & most of the 1980s until 2001 were by far the most prosperous times that generated the most non-inflationary recession-proof economic growth of 4% or greater. These were periods when an economic policy mix of strong stable dollars, tax rate cuts especially on the highest brackets, & reductions of the size of government, including regulations, & its claims on earned incomes were in place to a large degree – in short, these were periods that followed supply side economic principles. Coolidge, in the 1920s, followed all of these principles & Gingrich did too in the 1990s to a lesser but still high degree. Kennedy & Reagan both had to fight the propensity of Congress to spend as they championed supply side economic principles.

So as the House & Senate tax reform (tax cut) conference committee tries to reconcile differences between the two competing bills passed by each Chamber the past few days consider for yourself how many of the supply side economic principles detailed above are being applied - or ignored for that matter also. You can gage for yourself the effectiveness of whatever plan is developed vis-à-vis the principles of supply side economics described herein & make your investment & employment decisions accordingly.

But all of this pertains to an income tax system that is inherently against the American founding principles in that it makes a claim on the property of its citizens, namely their incomes & hence their liberty. After all, point #2 of Marx's Communist Manifesto is a heavy progressive or graduated income tax. An example of violated property rights is found in the repatriated profits clauses of both the House & Senate bills being reconciled in that overseas liquid profits accumulated under current law will be taxed whether these assets are repatriated or not – which amounts to confiscation by the government. Only an income tax system can violate your liberty & property rights like this.

Professor Williams, one of my lifelong mentors, has said that any tax system will work economically if federal spending is held to 16% of GDP. This is a corollary of Henry Hazlitt's quote @ the very top of this post but of course pertains only to funding the government. It does not take into account the loss of liberty inherent with any tax system that is not "uniform throughout the United States" or is not in "Proportion to the Census or Enumeration" specified in the Constitution.

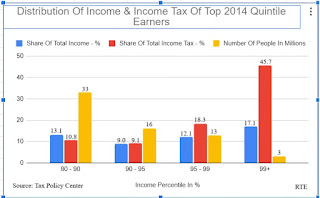

But there is a problem with trying to move away from an income tax system as the main source of revenue for the American economy that is shown in the graphics below – namely, 97.3% of the income taxes are paid by 40% of taxpayers (top two quintiles) & another 40% are in the negative income tax category (bottom two quintiles):

click on graphic to enlarge

The breakdown of the 65-million Americans in households in the top quintile is as follows:

click on graphic to enlarge

The problem with trying to break away from an income tax system & replace it with the FairTax, for instance, becomes obvious when you study the two graphics immediately above – not enough Americans pay any income tax or not enough income tax that breaking away from the income tax system is of interest to them. People in the bottom two quintiles not only do not pay any income tax they actually receive money back from the Treasury & the next 35% of income tax payers do not pay enough income tax that any of this is of interest to them @ all.

The poor economic understanding of the majority of citizens in the bottom 75% of households shown in the two graphics immediately above extends to them not grasping the idea that economic growth is the key to their future prosperity & better way of life – & that the tax policies of the country play an important part in achieving economic growth.

"This is what economic growth is: abundance coincident with fulfillment & happiness, all of us becoming flush with the good fruits of our ingenuity, more prosperous, more satisfied in our work & in our leisure, in our lives here on earth. Clearly economic growth is not worthy only because of its material benefits. It is a sign that humanity is functioning @ its highest level. Growth means that we are being good stewards of, & are applying the limitless abilities of the human mind to, the earth's resources. It means that we are equipping ourselves to be good neighbors, since as the economic pie gets bigger, so can everyone's piece of it." – See page 3 of reference below.

In summary, three quarters of the citizenry don't pay enough income tax that the income tax system worries them @ all – but it should worry them & for more reasons than one.

Reference: Kudlow & Domitrovic – JFK & The Reagan Revolution