"I don't think parents should be telling schools what they should teach." - Virginia Democrat gubernatorial candidate Terry McAuliffe responding in the September 28 debate - a rare moment of honesty in which McAuliffe, a strong supporter of teachers unions, said what he thought was in his best interest. Republican challenger Glenn Youngkin won the race.

"If you're a one issue voter & tax rate is your issue. We're probably not your state." - NJ Democrat Governor Phil Murphy during an interview in August. Murphy's opponent, Jack Ciattarelli, responded in political ads - "Not your state? Who says that?" - Jack went on to say "High taxes are the reason why young people can't afford to get started here."

But the most egregious statement made by any of these four candidates was Murphy saying he "wasn't thinking of the Bill Of Rights when he implemented these bans" to work, assemble, associate, & worship.

***

When I first wrote in the August 10 post that we would get a gage on how the 2022 midterms would play out based on the results of the California recall election of Newsome & the Virginia & New Jersey gubernatorial races I thought "the margins could be telling if close even in defeat" since all three states have Democrat majority constituencies.

However, that lukewarm assessment was before McAuliffe infuriated parents all over America with his above statement about parents not telling schools what they should teach. After McAuliffe's admission of Democrats' allegiance to the teachers unions @ the expense of parents & students, Youngkin should have won, & won big, & by extension helped Ciattarelli's campaign in NJ as Democrat destructive plans for America continue to be flushed out.

After all, what society would expect to last long that was not based on parents' responsibility for raising their children & specifically seeing that their children received a good education. My entire life was based on this.

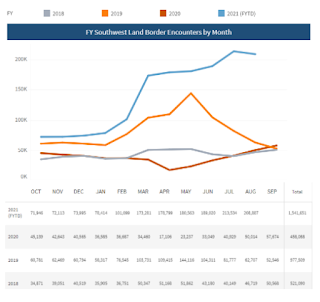

But who could blame McAuliffe for speaking out - what with 1) Americans indifference to hundreds of thousands of illegal aliens crossing the southwest border every month bringing unchecked Covid-19, just as long as it doesn't come too close to home to inconvenience a birthday party, 2) the shameful humiliating withdrawal from Afghanistan that so far seemingly does not pertain to any of the non-uniformed citizens on the homeland who feel they have done their patriotic duty when they perfunctorily say to those who have "thank you for your service," 3) the lack of concern about Biden's multi-trillion dollar spending bills that are mistakenly believed by the majority of people to cost nothing, & 4) the reappearance of 1970s style inflation that has been treated as unimportant because of advance government payments ($1.9 trillion in new spending in March & $4 trillion in Covid relief in 2020) that swelled savings during the first year of the Wuhan coronavirus pandemic & now are used to make up the cost difference in buying higher priced Christmas presents.

The problem for McAuliffe was that, unlike the above insults to freedom, he finally brought up an issue that got people's attention & 55.2% of registered VA voters turned out to vote. This amounted to 700,000 more voters than in the 2017 gubernatorial race.

Although Democrats held a 451,000-vote margin in VA in the 2020 presidential election, Youngkin won Virginia 50.57% to 48.64% (1,663,565 to 1,600,062). Republicans also won back the VA House of Delegates with a new margin of 52-48. Prior to the election Democrats held a 55-45 advantage. There are two Republican wins being challenged for a recount with leads of 94 votes out of 27,388 cast in District 91 & 127 votes out of 28,413 cast in District 85.

Ciattarelli overperformed in NJ, but Murphy won 51.1% to 48.2% (1,304,954 to 1,231,140).

Conservative news media constantly presents these results as a sweeping prediction for winning the 2022 midterms & the return of Trump to the presidency in 2024. This is not the lesson to be learned from the 2021 elections @ all.

Just think, in the TX 2018 Senate race Ted Cruz defeated Beto O'Rourke by 2.6% & the conservative media labeled O'Rourke a loser of ridicule ever since. Jack Ciattarelli loses NJ by 2.9% & the same conservative media calls him a hero. Not to mention Youngkin's win by 1.93%.

If you consider the two gubernatorial elections as one people interested in their children the combination shows a different lesson to be learned in that there were more votes for the two Democrat candidates than for the two Republican candidates - Youngkin won VA by 63,503 votes & Murphy won NJ by 73,814 votes meaning that 10,311 voters in the combined two states cared less about what Republicans, parents @ school board meetings, & citizens paying taxes cared about.

This is especially disheartening when you understand that NJ had a low turnout election. Although Ciattarelli far exceeded the less than 900,000 votes that Kim Guadagno had in 2017 the turnout was static compared to the increase in registered NJ voters. See graph below that shows the dramatic increase in NJ registered voters to the decrease in actual votes cast during the last six gubernatorial elections

The Republicans in NJ turned out every one they could for Ciattarelli while the Democrats did not turn out for Murphy - Democrats outnumber registered Republicans by over 1 million voters in NJ. NJ Senator Bob Menendez summed up the low Democrat turnout by saying that he was "struck by how few voters of color appeared to cast ballots" - an observation from a man who has spent a lifetime in NJ politics.

In short, we are outnumbered & only have a chance in low turnout elections with few exceptions like the squeaker in VA & other elections with gut wrenching issues like defunding the police.

Elections in 2021, with gut wrenching issues, & their results are as follows:

Voters in Minneapolis, the site of George Floyd's death in May of 2020, had a 53% turnout in which a public safety ballot question to replace the Minneapolis Police Department with a new Department of Public Safety was defeated 56% to 44% (78,454 to 60,887). This vote comes as Minneapolis is on pace for one of the deadliest years in recorded history.

In Seattle moderates won in the races for mayor, city attorney, & a key council race over liberals who had called to defund the police. The liberal candidate for mayor had called for cutting the Seattle Police Department's budget in half. The liberal city attorney candidate had been a police & jail abolitionist. First term mayor Jenny Durkan (the summer of love girl) did not seek reelection.

The powerful NJ Senate President Steve Sweeney faced a surge of Republican voters as support for Democrats disappeared in the suburbs & rural areas - Sweeney lost to newcomer Ed Durr, a truck driver, by 2,298 votes. The state's high tax rate & disapproval of shutting down public schools was often given as the reason. Voters took this out on Sweeney, NJ's second most powerful politician, as Murphy survived with just a scare.

After being defeated in the Buffalo mayoral primary by 1,507 votes by Democrat Socialist India Walton, four term incumbent Byron Brown orchestrated a write-in campaign that he won 59.57% to 39.88% (38,338 to 25,773). Walton ran as a Socialist with endorsements from AOC & Bernie. Brown had support from moderate Democrats as well as Republicans.

NYC picked the most law-&-order candidate in the ranked-choice Democrat primary in June by a mere 7,197 votes but did not go all the way in the general election with Curtis Sliwa, the Guardian Angels founder who was defeated 4 to 1. Nonetheless, this was another setback for the progressives, @ least on the surface, as NYC elected Eric Adams mayor, a former police officer who ran a public safety campaign.

Democrats think the above results would have been much different if the Biden spending bills agenda would have passed before the election.

And Democrats put their money where their mouth was in that three days after the November 2 election, not believing &/or caring about the above voter signals, Pelosi brought the infrastructure bill to the floor of the House & it passed - but only because thirteen Republicans voted for it (Bacon - NE, Fitzpatrick - PA, Garbarino - NY, Gonzalez - OH, Katko - NY, Kinzinger -IL, Malliotakis - NY, McKinley - WV, Reed - NY, Smith - NJ, Upton - MI, Van Drew - NJ, & Young - AK). These Republicans must think their constituents want this bill & therefore it is in their best interest to vote for it. After all, nineteen Senate Republicans [Blunt (MO), Burr (NC), Capito (WV), Cassidy (LA), Collins (ME), Cramer (ND), Crapo (ID), Fischer (NE), Graham (SC), Grassley (IA), Hoeven (ND), McConnell (KY), Murkowski (AK), Portman (OH), Risch (ID), Romney (UT), Sullivan (AK), Tillis (NC), & Wicker (MS)] had already voted for Infrastructure before it was sent to the House for passage.

Yes, without the above listed thirteen House Republicans Biden's spending program would have come to a halt, @ least for a while longer, because AOC & her Squad voted against Infrastructure thinking it took away their leverage for the much larger Build Back Better (BBB) bill that has since passed the House.

The six Democrats who voted against the Infrastructure bill were AOC - NY, Cori Bush - MO, Jamaal Bowman - NY, Ayanna Pressley - MA, Rashida Tlaib - MI, & Ilhan Omar - MN. With this vote these people reaffirmed themselves as the six most dangerous Members in the People's House.

The shame of it all is that the so-called Infrastructure bill ($1 trillion & 2,702 pages) has only a quarter of the additional spending going toward what most people think of as infrastructure - highways, bridges, airports, & tunnels. The other three quarters goes to Democrat spending priorities like the Green New Deal - for example, $21.5 billion for creation of the office of clean energy demonstrations, $2.4 billion for advanced nuclear reactor projects, $3.5 billion for carbon capture, $8 billion for clean hydrogen, & $5 billion for investment into energy related projects. And loosely regarding infrastructure there is $66 billion in new subsidies for Amtrak. Is any of this how you want your tax dollars spent? Does any of this follow the Constitution?

So now that the above listed thirteen House Republicans paved the way Pelosi lost no time & brought the much larger BBB bill to the floor on November 19 & it passed strictly along party lines - only Democrat Jared Golden of Maine voted against it.

BBB is written to appear to cost $2 trillion over the next ten years. But the dishonesty of this figure is appalling. In reality it costs closer to $5 trillion.

Like a jigsaw puzzle BBB was presented to the Congressional Budget Office (CBO) for scoring with programs intended to remain for the full ten years shown as expiring in one year (e.g., the enhanced child allowances were presented to CBO as expiring in one year @ a cost of $130 billion instead of $1.5 trillion over the full ten years) while paying for them with ten years of tax increases - one year of expenses with ten years of tax increases provides quite a charade in budgeting especially when half the child allowances have already been paid monthly to 36 million families starting July 15 under the American Rescue Plan Act of 2021, aka the Covid-19 Stimulus Package. Did any inquisitive journalist ask Pelosi, or any other Democrat who supported BBB, if they really planned to drop this entitlement after one year & if not where were they going to get the other $1.37 trillion dollars since all of the tax increases were included in the bill?

Similar BBB budget deceptions were used to hide the true ten year cost of the enhanced Earned Income Tax Credit expansion, subsidies for ObamaCare premiums, the new child care entitlement, & universal pre-K. The full ten year tax increases in the bill were purposely misused to make it look like BBB was funded without adding to the deficit.

I don't know how anyone taking the oath of office could support these absurd pretenses intended to create a respectable appearance of a congressional bill.

And BBB exposes Democrats hand as the party of the rich in that the state & local tax deduction (SALT) is expanded from $10,000 to $80,000 meaning that a Democrat in NY, NJ, or CA who is in the current top 37% federal tax bracket & took the full $80,000 SALT deduction (& there are plenty of them) would see their federal income taxes reduced by $25,900 net ($70,000 X 0.37) meaning that middle America is subsidizing tax cuts to high income Democrat households.

Put simply, the Infrastructure bill is falsely named & BBB employs dishonest accounting.

So there certainly are different lessons that the two parties think should be learned from the 2021 elections. White House Chief of Staff Ron Klain said "I do think the voters sent a message on Tuesday. They wanted to see more action in Washington. They wanted to see things move more quickly. And three days later, Congress responded." - referring to the passage of the Infrastructure bill & counting on passage of BBB in the immediate future. Republicans have a unified message, so far, against BBB.

Republicans are counting on the above positive election results, in VA & NJ & across the country, as signals that the electorate understands that the seeming incompetence of Biden & Harris is really the execution of a deceptive plan to transform America into a Socialist/Communist nation. Republicans think the 2021 election results prove that people see that Biden & Harris are leading America into 1) record illegal immigration flows that have really been purposely brought on by Democrat policies including downright neglect, 2) large increases in inflation that are really more in line with the 10+% annual increases of the 1970s than the reported 6.2% year over year October figure due to rent-housing methodology changes that lower the entire Consumer Price Index, 3) energy dependence after we had reached energy independence for our own domestic needs, 4) soft on crime enforcement, & 5) seeing everything through a fanatical uncompromising race lense that tears down the entire society & replaces it with nothing of substance or value.

Democrats are counting on passing BBB & the simple fact that 36 million people have already received half ($300 per month per child under 6 & $250 per month per child 6 to 18) of the enhanced child tax credits every month since July 15, as well as the promise of receiving up to $4,000 per month federal government paid family & medical leave. Democrats figure that illegal immigration will not be a factor in the 2022 midterms if illegals have not moved into voters neighborhoods by next November & that inflation will be negated by the money people have received from the government as Covid-19 payments. They are willing to double down on energy dependence in the name of climate change & are too far invested in soft crime enforcement & critical race theory to abandon them. Democrats are counting on people not remembering the humiliation of the Afghanistan withdrawal - after all, they figure, Afghanistan is thousands of miles away & will be long forgotten, if ever considered, by November 2022.

Biden is pulled in two directions - one direction by the Democrat progressive socialist wing in both the House (AOC & the Squad) & Senate (Bernie, Warren, Brown, Whitehouse) & the other direction by the more practical wing that realizes more elections need to be won in order to achieve their goal - people like White House Chief of Staff Ron Klain, National Security Adviser Jake Sullivan, & Susan Rice domestic policy adviser. Biden, ever feckless, is willing to go in either direction.

Hillary has complained about the 2016 presidential election for the last five years (if you subtract the popular vote totals in 2016 in CA & NY Trump held a 3-million vote lead in the other 48 states & recorded a 304 to 227 electoral college win by a combined total of 77,736 votes thanks to three states - PA, MI, & WI - thereby showing how set up the potential reversal of this result was in 2020). Stacey Abrams has never conceded the 2018 Georgia gubernatorial race for the last three years (although she recently denied this), after losing by 1.4%. And of course Trump has not accepted the Biden win (this time if you subtract the popular vote totals in CA & NY Biden was still ahead in the other 48 states by 36,327 votes in winning the electoral college 306 to 232 thanks to another three states - AZ, GA, & WI - by a combined total of 42,918 votes showing another turn around is highly possible in 2024) instructing his legal representatives to make one unproven claim after another on TV without ever offering one scintilla of evidence in court that could stand up in over 60 cases including cases before judges he appointed.

Of the above three examples Trump is the most dangerous because he demands loyalty to himself & the idea that the 2020 presidential election was stolen from him - or he will turn against any candidate, like Congressman Chip Roy of Texas with a liberty score of 100%. You can expect to see in both the 2022 midterms & the 2024 presidential race an endless TV tape of the January 6 break in of the Capitol & the most disgusting images of Trump resulting from Pelosi's investigation - thereby turning off many Independents & moderates. But, more importantly, to those of us who believe in & follow the Constitution, what Trump asked Pence to do that day was unforgivable regardless of how cheap or cooked up the attack on the Capitol was. This divisiveness, even in a small number of close races, could turn some 2022 midterm congressional races to the Democrats, resulting in a continuation of the Biden/Harris administration unchecked except for the fragile most unlikely of sources within the Democrat Party.