The President's 2018 fiscal year budget, which serves as a recommendation to Congress (i.e., the president proposes, congress disposes) was released on May 23.

Although the budget contained many controversial points regarding deficit reduction over 10 years (2018 through 2027) such as 1) $250 billion for repealing & replacing ObamaCare, 2) $616 billion for reforming Medicaid & CHIP, 3) $272 billion for reforming welfare, 4) $143 billion for reforming Federal student loans, & 5) $72 billion for reforming disability programs it also included deficit increases such as $200 billion for supporting $1 trillion in private/public infrastructure investment & $19 billion establishing a paid parental leave program.

The yearly budget totals for spending & revenues project a declining deficit every year except 2019 & returns the budget to balance & even produces a small surplus in 2027. The budget produces $3.6 trillion in spending reductions over 10 years & by including the economic gains that are expected from Trump's fiscal, economic, & regulatory policies the deficit is shown reduced by $5.6 trillion compared to the current fiscal path. Non-defense discretionary spending is reduced by the 2-penny plan (2% each year) from $479 billion in 2018 to $378 billion in 2027.

And of course the budget proposal includes "funding to plan, design, & construct a physical wall along the southern border as directed by the President's January 25, 2017 EO."

Now you can decide for yourself how much appetite Congress has for any of Trump's plans indicated above as they exercise the power of the purse in the appropriations process.

But the most controversial part of Trump's budget is found on Table S-9 entitled Economic Assumptions – where Trump assumes a 3% economic growth rate & then not until 2020 (2.5% in 2018 & 2.8% in 2019). Democrats say this 3% projected growth rate is not attainable thereby making the entire budget unrealistic.

Over the past nine years annual economic growth has averaged 1.4%. Annual economic growth has been 2.1% since June 2009 when the recession ended – the weakest expansion of the post World War II period. Even a one percentage point difference in the growth of our economy translates into nearly $200-billion a year of goods & services not realized meaning fewer jobs & a lower standard of living than would be produced from a more robust economy.

Between 1950 & 2005 annual economic growth of 4% or higher was common place. See graphic below.

click on graph to enlarge

The following graphic indicates that growth in gross domestic product (GDP) is a function of labor & productivity powered by capital investment. Stanford economics professor John Taylor teaches that economic growth equals employment growth + productivity growth. Productivity growth is powered by increases in investment, innovation, & entrepreneurship. Long term, the economy grows because of capital & savings.

Now this blog has documented over eight years how BO's policies intentionally kept America down. In the case of the economy higher taxes, massive regulations, & the certainty that both would increase under BO forced entrepreneurs to wait for another administration before moving forward with investments that would increase economic growth, jobs, productivity, & accordingly everyone's standard of living. With Trump being one of the world's most successful businessmen we have a real chance to reverse the Death Of Democracy spiral & return to the liberty to abundance stage of our republic.

Trump's budget calls for lowering both the individual & corporate income tax rates, eliminating both the 3.8% ObamaCare surtax on capital gains & dividends & the 0.9% additional Medicare payroll tax. Trump plans to replace two government regulations for every new one made – the business cost of regulatory compliance in 2012 was nearly $2-trillion. BO's annual compliance cost burden for an average U.S. firm is 21% of its payroll thereby leaving little or no room for investment of any kind. In summary, Trump's budget plan provides a much better climate for businesses & workers to prosper. Already $55-billion of burdensome regulations have been repealed thereby boosting confidence of business leaders.

See table below that identifies taxes & government regulations & red tape as the two largest problems of small businesses.

From 1948 through 2016 the working age population grew 1.1% per year on average. Part of the Democrat's skepticism about Trump's 3% economic growth target is that baby boomers are retiring @ a rate of 10,000 per day (they claim this is a large part of the reason that the labor force participation rate has declined from 66.0% in 2008 to 62.7% in May) & family sizes are getting smaller & I hasten to add starting to form later in life than they did for most of the twentieth century thereby retarding economic growth. The census bureau forecasts an annual growth rate of 0.3% for the working-age population for the next 10 years – the same rate as the last nine years.

Productivity growth averaged 1.1% the past nine years (0.5% per year from 2011 through 2016) resulting in average annual output growth of 1.4% when you add the 0.3% additional hours worked each year. See table below for relationship of productivity, output, & hours worked from 1948 through 2016.

So with productivity down, & projected to stay down, & the labor force growing slowly how does Trump justify 3% economic growth in his budget proposal?

It must first be understood that every economic policy of the past eight years under BO was instituted to make people dependent on the government – not produce a viable economy that people prospered in. If you don't believe me name one policy that BO put in place that enhanced free enterprise.

It is true that the labor force participation rate declined as baby boomers retired & BO bares no responsibility for this. But this is not the case for the decline in family sizes (or their postponement to even start a family) – young & old alike found employment precarious with deep cuts in salary for experienced people, if they still had a job @ all, while young college educated people could not find jobs in their field & were forced to live in their parents basements as a result of BO's policies – this was documented by statistics, graphs, & personal experience in many posts over the years on this blog. Much of the decline in the growth of the labor force can be laid @ the feet of BO.

In a similar vein it is easy to see why businesses did not expand their facilities or equipment that would increase productivity with the only certainty being that their taxes & number of regulations would increase under BO or Hillary Clinton, the surprise loser in the presidential election.

In summary, BO's policies precluded both family formation which hindered labor force growth & investment that would increase productivity.

The retirement of baby boomers is far from the entire story regarding the decline in the labor force participation rate. Check out the graphs below to see that the declines in labor force participation rates of both teenagers & young adults is even greater than the overall decline (3.3% from 2008 to the present). In fact for people 65 & over the labor force participation rate increased 4.2% from 2004 to 2014 going from 14.4% to 18.6% while the teenage rate dropped from 40.2% in 2008 to 34.3% in 2015.

The trick to achieving 3% growth is to get the aforementioned people back into the labor force & in many cases off government dependence. Part of Trump's budget proposal calls for people to join the labor force in order to qualify to continue receiving government benefits like food stamps.

Professor Taylor estimates that reversing the declining trend in labor force participation & getting the aforementioned people back to work will produce a 2% growth rate in employment when coupled with the average population growth rate of the past 68 years. When businesses start to invest in capital improvements once again productivity growth of @ least 2.3% (average of the past 68 years) is a reasonable expectation resulting in GDP growth of 4.3% – much higher than Trump's assumption of 3% growth.

Trump picked 3% growth instead of 4.3% because there will be inefficiencies productively returning the aforementioned people to the labor force. It is a fact that people who have been out of the labor force for years most likely have lost skills & will need training. Also it can be hard to get current recipients of government benefits to return to the labor force – hence the incentive to work in order to continue receiving benefits. In addition, many of the teenagers & young adults listed above will have low skills but for the first time in their lives they have a real chance to achieve a better life than currently lies before them.

The following graphic shows there are currently a million more openings than there are people available to fill them. Someone who wants to get trained for these jobs will walk, not have to run, past the competition, get a better more dignified life, & contribute to the growth of the U.S. economy.

click on graph to enlarge

The following two graphics detail another version of the trouble small businesses are having finding qualified workers. What a new lease on life for those who take advantage of it.

click on graphics to enlarge

We are coming from way down & it certainly didn't have to be this way. The following two graphics show another measure of potential employment - just to get back to levels where we once were.

Click on graphics to enlarge

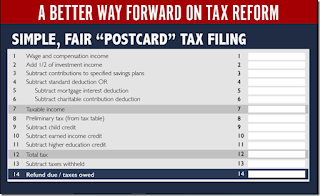

Another highlight of Trump's budget is: "Tax Reform & Simplification. We must reduce the tax burden on American workers & businesses, so that we can maximize incomes & economic growth. We must also simplify our tax system, so that individuals and businesses do not waste countless hours and resources simply paying their taxes."

Below is the postcard form that the House (Ryan) is proposing to be used in filing income tax returns in the tax simplification process. But it is still an income tax which means with its large deductions it gives the perception that government is free to over half the population & its claims on earned income can easily be raised.

In summary, Trump's fiscal year 2018 budget is just another reason the Democrats want to get rid of him. Democrats fear that Trump will reverse the political correctness that they depend on to confuse & mislead people so that no one any longer knows right from wrong - Democrats are like fish caught on hooks fighting for their lives – getting rid of Trump gives them a chance to resuscitate themselves.

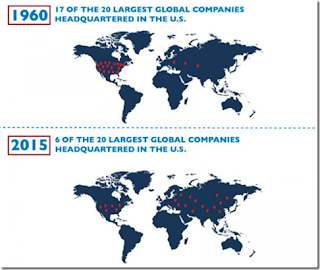

In his work to make America great again Trump is looking to return prosperity to the citizenry by getting them off of government dependence & making America once again a land where free enterprise thrives. The above analysis shows the principles contained in Trump's budget is a start to reverse the terrible direction this country has gone in, not only during the last eight years but since 1960 as shown on the graphic below.

YOUR presentation was very good, but Democrats are out to get Trump, any way they can. They might do it.

ReplyDeleteHow you ask? Coming elections democrats can win big. Why - there is a very large Hispanic vote, and if they get organized, they can give Democrats big edge. They hear stories Trump shipping back home illegal immigrants and that scares them. Trump does not realize many benefits Americans enjoy today, were products of immigrants to U.S.

A LOT OF UNEMPLOYED PEOPLE voted for Trump, figuring he would create jobs for them - has not happened, but still early in the game, only in office several months.

I for one think Trump is trying to do too much in too short a period of time.

See what happens.

Forgot to mention medical benefits to low wage earners to be cut. I seem to remember when Obama started his medical care program, they said second year premiums would go up a little, but third year would shoot up much higher (we now are in third year). Trump trying to do a good job, but things are not panning out for him. True low wage earners normally do not vote - this time can be different, when they see their medical premiums shoot up.

DeleteNot much knowledge of the fiscal but I do know that Trump is smart and that anything the Democrats say will be negative. MAGA!

ReplyDeleteOne big question - on line 2 of Ryan's postcard, what about those whose investment income is presently in tax free [federally] municipal bonds?

ReplyDeletePlease keep in mind that Republicans have not finalized tax reform – you can’t really prove they have started.

DeleteFirst they want to tackle ObamaCare & that does not seem close – but one way or another they will move to tax reform only after ObamaCare reaches some conclusion either good or bad.

Ryan’s postcard is far from law but let’s work with it.

Please note that 1/2 of investment income is tax free on line 2 of the postcard. Since Ryan is still proposing an income tax the muni bonds may retain their current status & are not included @ all on line 2. Most likely Ryan will still use your tax free interest in the calculation to see if Social Security benefits are taxable but this is current law & applies to you now.

If 1/2 of taxable interest instruments become non taxable the issuers will probably lower the interest they pay because they are only paying it now to offset the taxes holders of these instruments currently pay. They will then compete with the bonds you hold – both will pay no federal tax. If the interest rates drop below your coupon rate your bonds will appreciate in value in the bond market & you can either sell realizing a capital gain (1/2 of which may be taxed) or hold to maturity. The problem with holding to maturity is that if the coupon rates stay below your current rate that will be the rate you will get when you reinvest meaning a loss in the future from your current income. At least selling the bonds produces higher proceeds which means more money invested in lower coupon rates yields the same current income.

The problem with the other half of the investment income – namely muni bonds being taxed as ordinary CDs are now. It would seem that is a breach of contract or @ least the understanding Ryan has with the bond markets so I don’t think that will happen. I don’t think you can have the billions of dollars in the muni bond market & then say all of a sudden these bonds are taxable. Ryan is too politically correct for that. The next Speaker would quickly look to reverse this if Ryan tried it.

One point to consider is that if inflation heats up, & rates go up, your bonds will decrease in value in order for the coupon payments to be competitive in the bond market. You can hold to maturity but you will receive the same coupon interest each payment which will not keep up with inflation in this example since it is fixed income resulting in a net real loss over the years (declining real income). Your principal will also be worth less in this case – which it really is now also. To counter this you could save some of the coupon interest payments & add this sum when you reinvest – but you cannot spend this money meaning that it really is an inflation tax. The best way to combat this is to ladder your maturity dates.

I think the point is we do not know right now what will go on line 2. I just checked a Forbes article & it was no help – did not mention tax free income.

We will have to keep our eyes open for these details & if I learn of anything I will let you know. But I think we are quite a few months from this taking shape.

Nothing is easy anymore. LOL. Thanks Doug.

Delete